Bloomberg has recently published a research paper revealing the creation of BloombergGPT, a large-scale generative artificial intelligence (AI) model. This particular large language model (LLM) has undergone extensive training on a diverse range of financial data to cater to various natural language processing (NLP) tasks relevant to the financial industry.

While recent advances in AI based on LLMs have already showcased a range of exciting applications across various domains, the financial industry’s complex terminologies and complexity necessitate the creation of a domain-specific model. BloombergGPT is the initial stride towards developing and implementing this cutting-edge technology in the financial industry.

BloombergGPT will help Bloomberg enhance the existing financial NLP tasks, including named entity recognition, sentiment analysis, news classification, and question answering. Additionally, It will provide novel opportunities to leverage the vast amount of data accessible through the Bloomberg Terminal to better serve the firm’s clients while fully unleashing the potential of AI in the financial domain.

Bloomberg has been at the forefront of utilizing Artificial Intelligence (AI), Machine Learning, and Natural Language Processing (NLP) in finance for over a decade. Currently, Bloomberg supports an extensive and diverse range of NLP tasks that will significantly benefit from a finance-specific language model.

To create a model that performs exceptionally well on financial benchmarks while maintaining competitive performance on general-purpose LLM benchmarks, Bloomberg researchers pioneered a novel approach combining finance data and general-purpose datasets.

To achieve this groundbreaking feat, Bloomberg’s ML Product and Research team collaborated with the firm’s AI Engineering team to develop one of the most extensive domain-specific datasets, utilizing the company’s pre-existing data creation, collection, and curation resources.

As a financial data company, Bloomberg’s data analysts have gathered and preserved financial language documents for over four decades. The team drew from this vast archive of financial data to build a comprehensive 363 billion token dataset comprising English financial documents.

Bloomberg has released a research paper announcing the creation of BloombergGPT, a new large-scale generative AI model designed specifically for the financial industry. Over the last decade, Bloomberg has been at the forefront of implementing AI, machine learning, and NLP in finance.

With BloombergGPT, the company has created a finance-specific language model that can support a variety of NLP tasks in finance, including sentiment analysis, named entity recognition, news classification, and question answering.

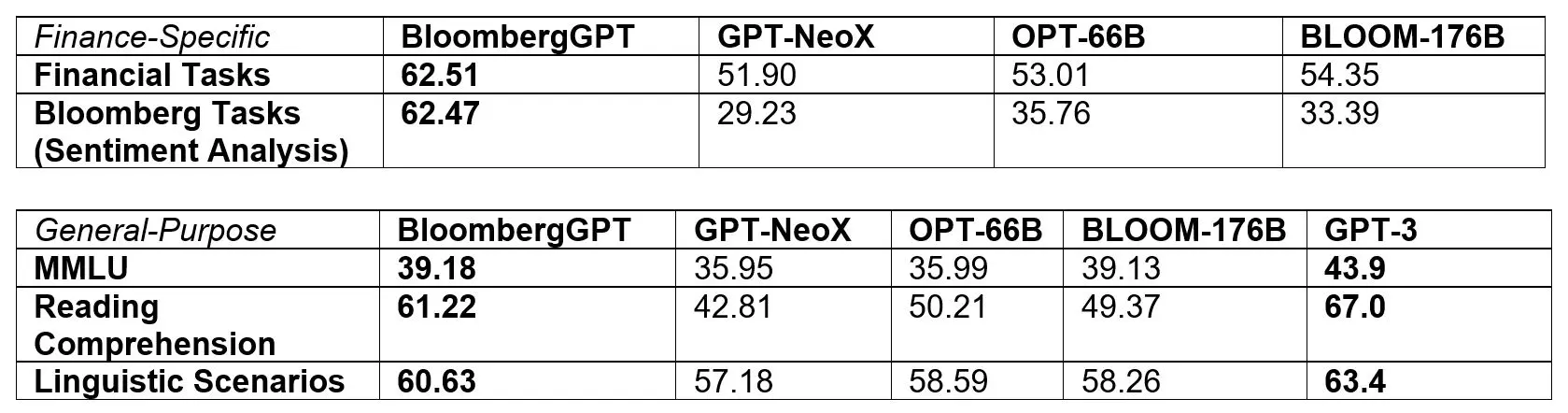

To create the model, Bloomberg researchers combined finance data with general-purpose datasets to create a training corpus of over 700 billion tokens. They then used a portion of this corpus to train a 50-billion parameter decoder-only causal language model. The resulting BloombergGPT model outperforms existing open models of a similar size on financial tasks by large margins while performing on par or better on general NLP benchmarks.

According to Shawn Edwards, Bloomberg’s CTO, BloombergGPT will enable the company to tackle new applications more efficiently than custom models for each application.

Meanwhile, Gideon Mann, Head of Bloomberg’s ML Product and Research team, emphasized that the quality of the model is due to the financial data Bloomberg has curated over the past 40 years. BloombergGPT will improve existing NLP workflows and offer new ways to delight customers with its capabilities.

Related Stories: