In this contemporary setup of growing digital technologies, biometric payment systems become a new cornerstone in safe financial transactions.

The systems authenticate by human uniqueness and are set on projecting growth of 18.2% between the years 2021 and 2028.

This rise reflects that they will be able to attain an integral role in the financial operations of tomorrow, reinforcing its revolution in how we manage money.

To further explore the potential and intricacies of these technologies, visit yuupay.com. This resource-rich site dives deep into payment technologies, offering detailed insights on a range of topics from biometric payment systems to the intricacies of using platforms like Samsung Pay, Shopify, and Square.

Whether you’re a small business looking to understand transaction fees or a merchant interested in fraud prevention and online banking solutions, yuupay.com provides valuable merchant insights and practical advice to navigate the complex landscape of modern payment options.

Table Of Contents 👉

Biometrics As It Stands

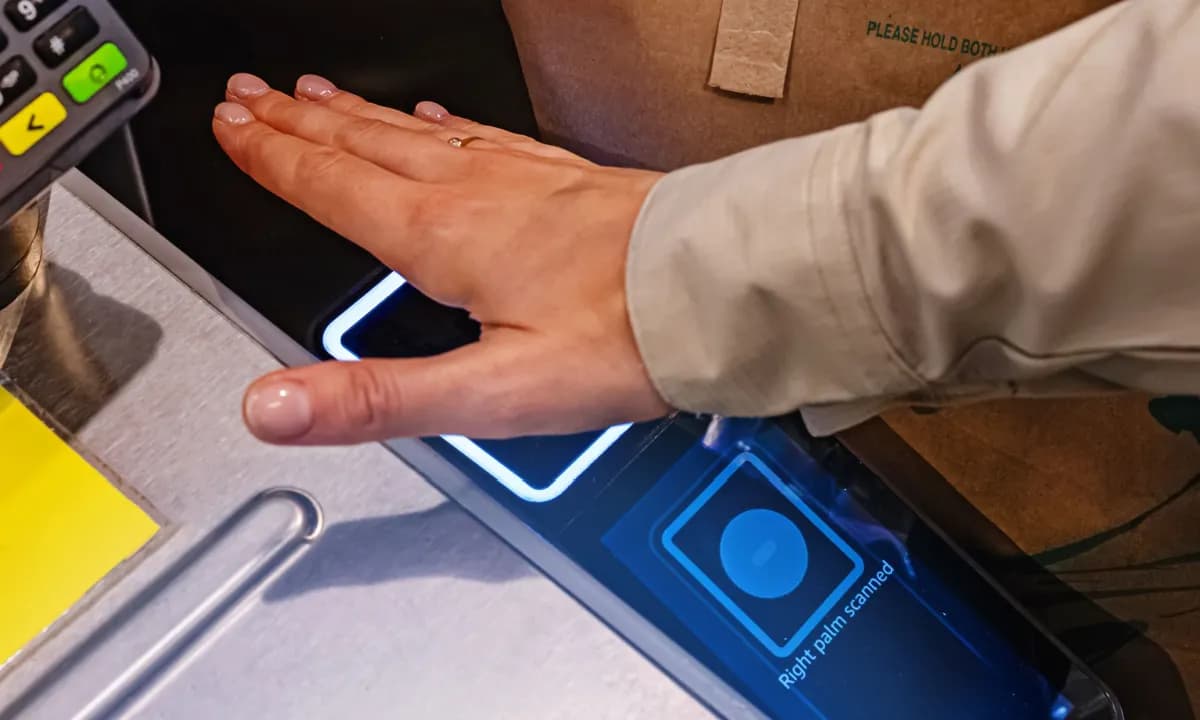

The new biometric payment technologies use fingerprint, facial recognition, and iris scanning unique identifiers to authenticate transactions.

This research would have a higher level of security compared with the traditional PIN or password, which can easily be compromised or forgotten.

For instance, the accuracy of facial recognition systems has been reported to increase more than 20% in just the last two years and now they have become more and more reliable in approving transactions both securely and quickly.

Advantages of Biometric Payments

Improved Security

These systems greatly minimize fraud, and reportedly cases resume to as low as 30% incidents of fraud when put into application. These are based on the uniqueness of physiological features that guarantee that the system is difficult to compromise or pass through.

Convenience

These systems bring down the transaction time sharply to as little as about 50%. This efficiency is particularly important in fast-paced retail environments where customer satisfaction and turnover rates depend on speed.

Challenges and Concerns

Privacy and Data Security

Managing sensitive biometric data can be quite problematic since about 30% of consumers have the fear of an eventual breach of their biometric data.

This means that the strong implementation of data protection is conducted to provide assurance to the consumers but also in compliance with worldwide data protection.

Inclusivity

Biometric systems may inadvertently exclude people with physical disabilities, possibly hitting up to 15% of the global population.

This raises the question of how to design and implement fair biometric technologies, underpinning the need for inclusivity in design and alternative means of authentication.

Cases of Global Adoption and Examples

Sweden

Concerning Sweden, already an impressive 60% of retailers within the major urban areas are engaging with this, or have switched to, fingerprint payments, so biometrics in European retail is certainly on the move now that both readers and technology are showing some maturity.

Japan

Over 500 vending machines in Tokyo have been installed with facial recognition, serving the tech-savvy population.

So this subtly indicates that biometrics technology is culturally acceptable in connecting common people with technological integration in commerce.

The Biometrics Future of Payment

Biometric payment systems are promising with ongoing advancements in AI to further enhance the safety features embedded in the systems, yielding a 40% reduction in fraudulent transactions by an extra 40% in the next five years.

Besides, as technology matures, it would spell even more innovative applications that could bring further ease and security to digital transactions.

Biometric payment systems can revolutionize secure financial transactions because they combine the improvement of security with ease of use for the end-user, through the power of advanced integrations of technology.

There remain obstacles in its way, however, not much with regard to privacy and inclusivity, given the pros that biometrics present.

In other words, when in fact technology further takes over, soon enough it will be biometric systems as the standard in both secure and efficient financial transactions.

Stories You May Like