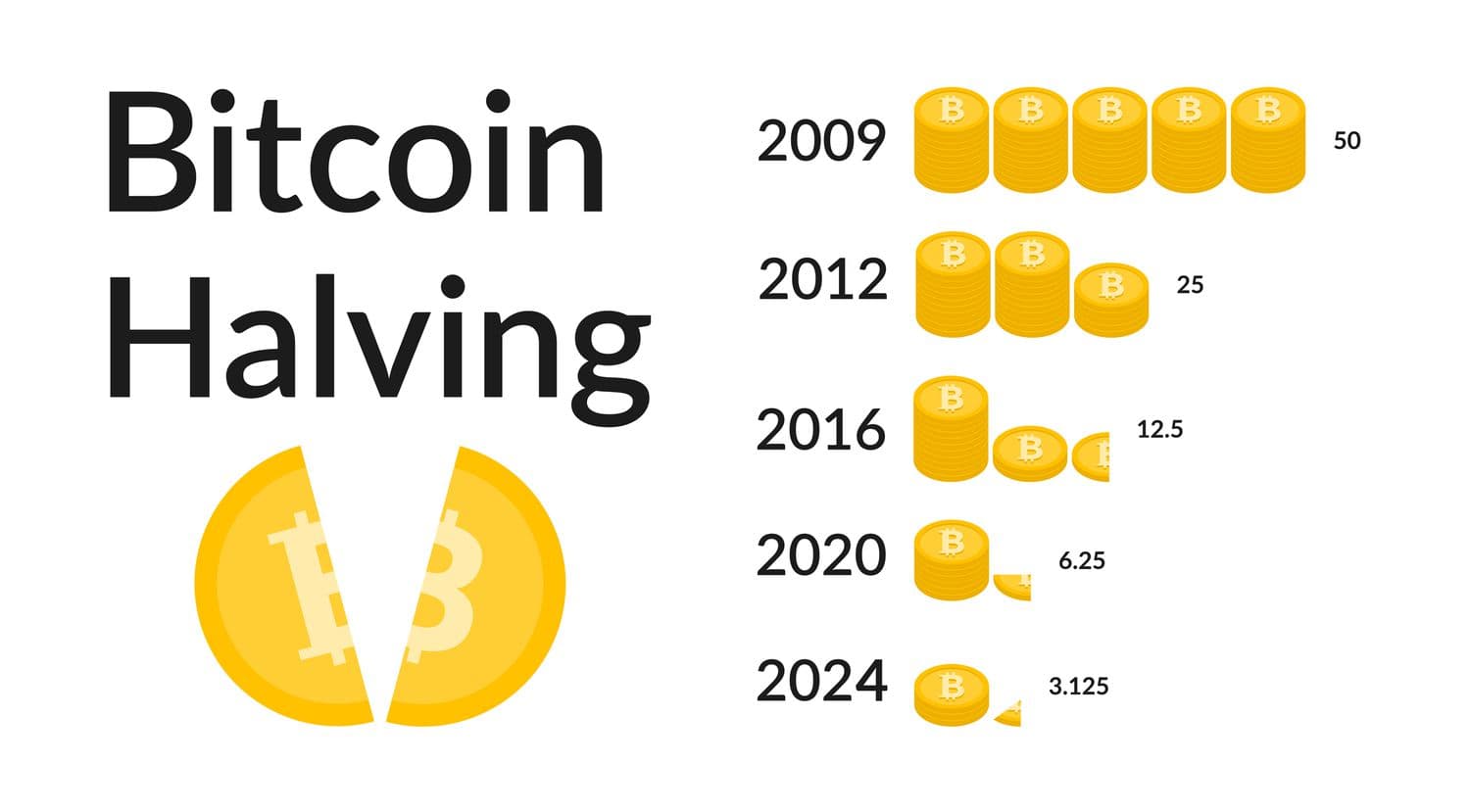

Bitcoin will be halved in April 2024, exciting the bitcoin community. This mechanism halves mining benefits every four years. After the crypto winter of 2022 and the economic collapse of 2023, traders and purchasers expect many changes.

Prepare for bitcoin halving 2024 with ChangeNOW! We eagerly await bitcoin’s 2x decrease. Preparing for this event and understanding its importance may improve your investing performance. ChangeNOW helps you handle changes and maximize results.

Table Of Contents 👉

Impact of halving on the market

Historical context and current assumptions

Due to a decline in new coins, steady or growing demand raises Bitcoin prices. Analysts like Tim Draper and Pantera Capital expect prices to hit $250,000 and $150,000 by 2024.

Potential impact on investment activity

The expected influence of the halving on the market and investment activity. Institutional investors are likely to increase involvement after the US and Hong Kong ETF introductions. JPMorgan expects Bitcoin to reach $45,000 by 2025.

How to Prepare for the Halving

Strategies for investors

When anticipating the halving, investors should consider several strategies to maximize the potential for profits and minimize risk:

- Portfolio diversification: This approach helps to reduce risk.

- Investing over time: Putting away small amounts of money every day or month can help lessen the effect of price changes.

- Long-term investing: Looking at the bigger picture lowers the risks that come with short-term changes in the market.

- Technical analysis: Users should use technical analysis tools to keep an eye on trends and find good times to enter and leave the market.

- Finally, continuing education: Stay abreast of emerging trends and stay updated on the latest news about cryptocurrencies and the global economy.

FAQ About Bitcoin Halving

What does Bitcoin halving mean?

Bitcoin halving halves block rewards every 210,000 blocks, or approximately every four years.

In what case can halving increase the Bitcoin price?

A reduction of the new coins’ supply while keeping demand at an unchanged or rising level can increase prices.

How will experts anticipate Bitcoin’s price after the 2024 halving?

JPMorgan expects Bitcoin to reach $45,000, while Tim Draper expects $250,000.

What are investor risks?

Cryptocurrency investment is risky, particularly during halving and high volatility.

The April 2024 Bitcoin halving may have quite an impact on the world of cryptocurrencies.

However, giving accurate results is impossible, but history tends to confirm what it promises, that this event always results in an increase in the value of Bitcoin.

With the above mindsets, one should invest based on the market trends and prepare for potential price shifts.

Related Stories: